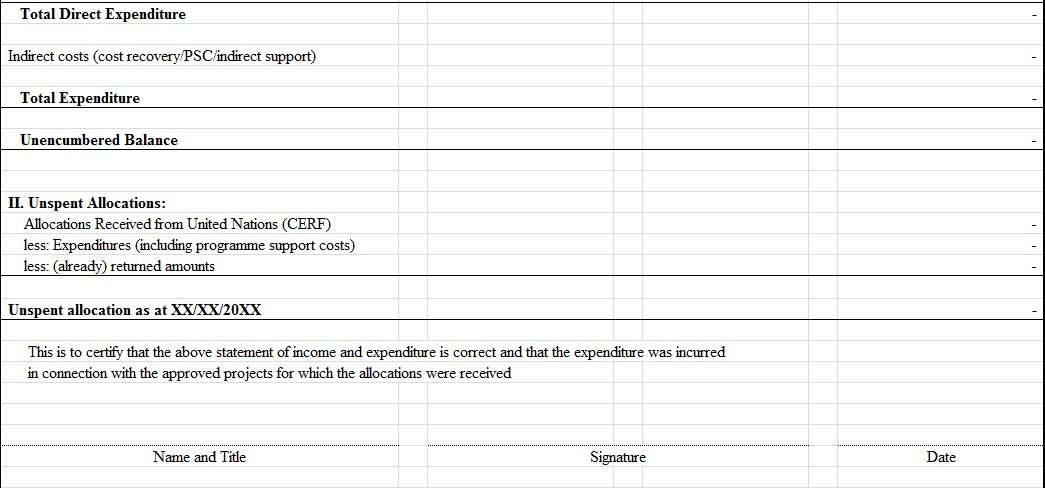

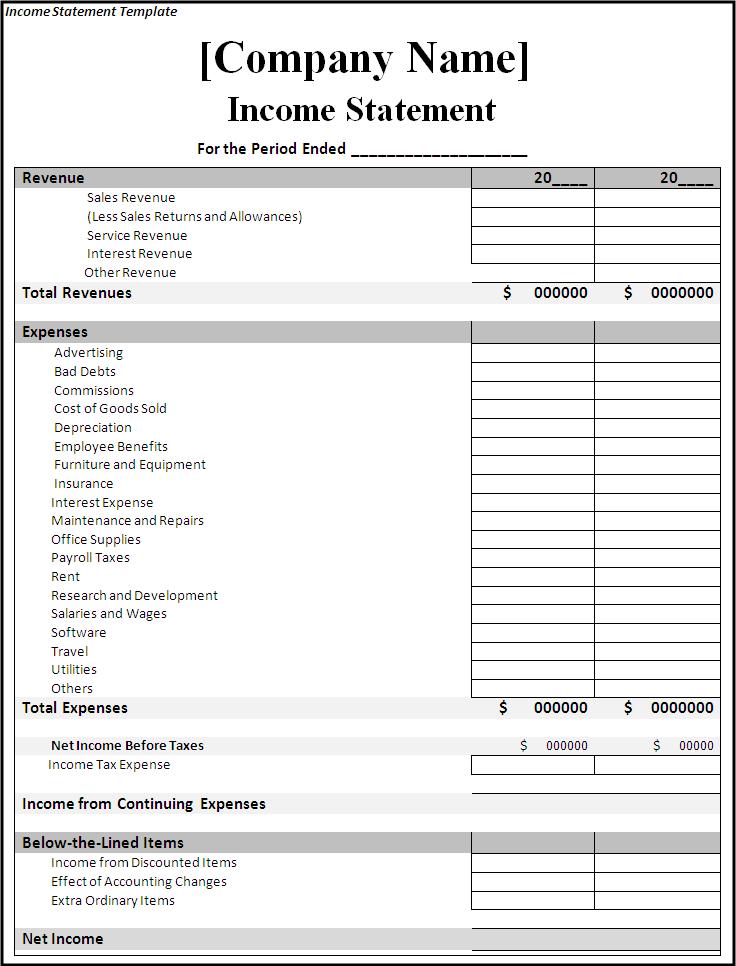

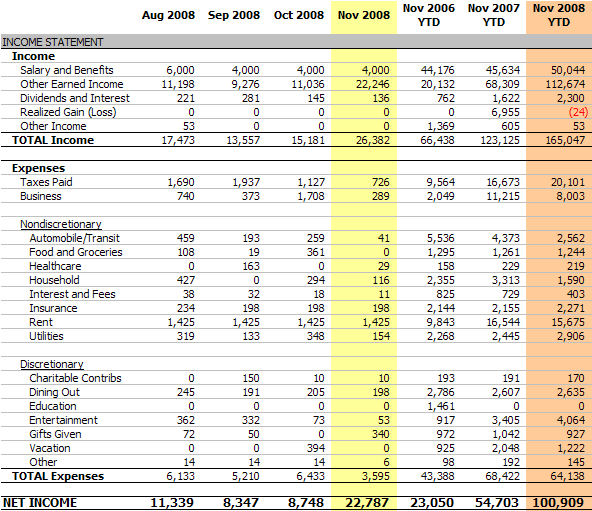

It is usually termed as excess income over expenditure. When the revenue generated by a non-trading or non-profitable organization exceeds the total expenditure incurred in a financial year, the Income & Expenditure account shows a surplus balance. Surplus and Deficit Balance of an Income and Expenditure Account These accounts primarily serve to find the surplus or deficit balance of an organization, taking both current income and expenses into account. Typically, these are nominal accounts, which outline an organization’s final accounts and are similar to that of profit and loss accounting by a business entity.

Outlined by non-trading entities, this account distinguishes capital from revenue and takes only the latter into account. Prepared on an accrual basis, this account records every income and expense in a particular year, irrespective of whether they are clear or not. What is an Income and Expenditure Account?Īn Income and Expenditure Account is the detailed summary of every income and expense incurred by an organization in a specific financial year. In this context, we are going to take up the discussion of what exactly an income and expenditure account is, what item comes in this account, and other such important aspects that will be dealt with here. Without this account, it would be havoc knowing where the money flowed at the end of the business cycle. This income and expenditure account is prepared for tracking the income and expenses of the business to know the surplus earned and deficit incurred in a period.

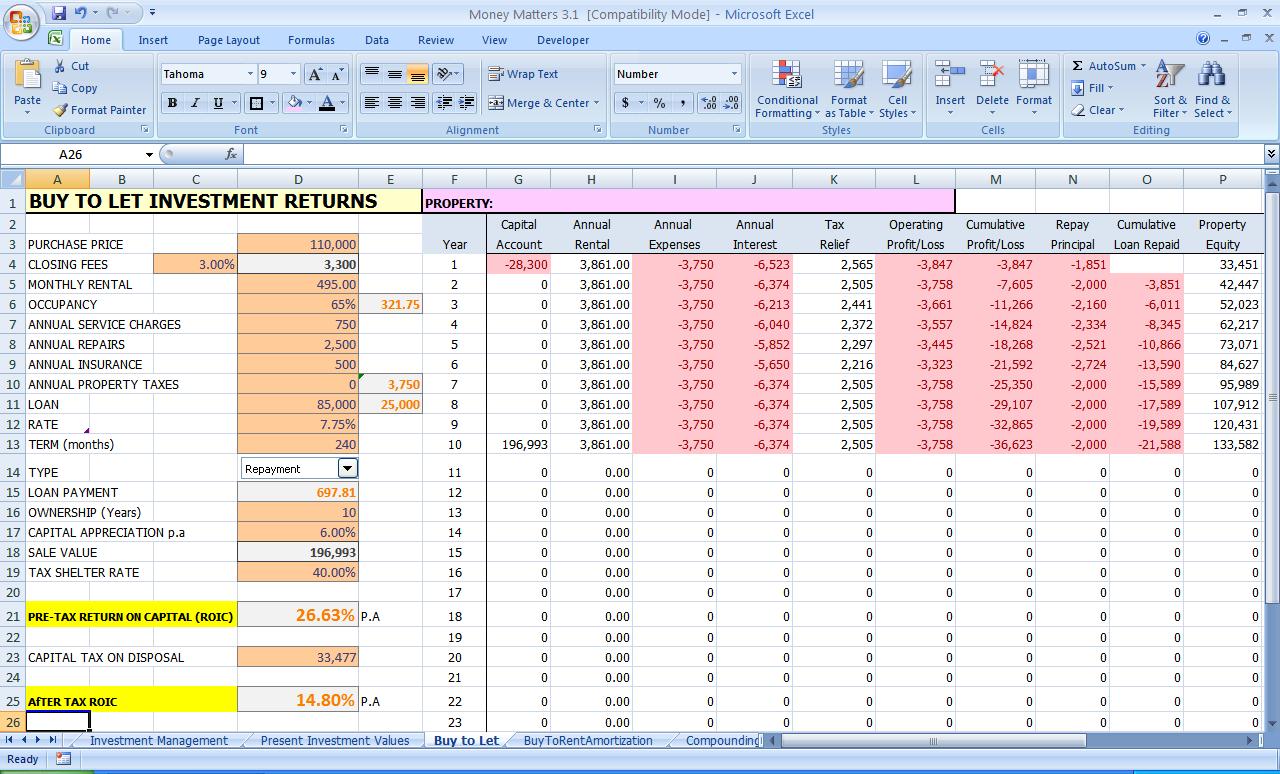

Similarly, business individuals follow this task of calculating and keeping track of their income and expenditure.

In our daily life, we do calculate and keep track of the record of our monthly income against all the expenses.

0 kommentar(er)

0 kommentar(er)